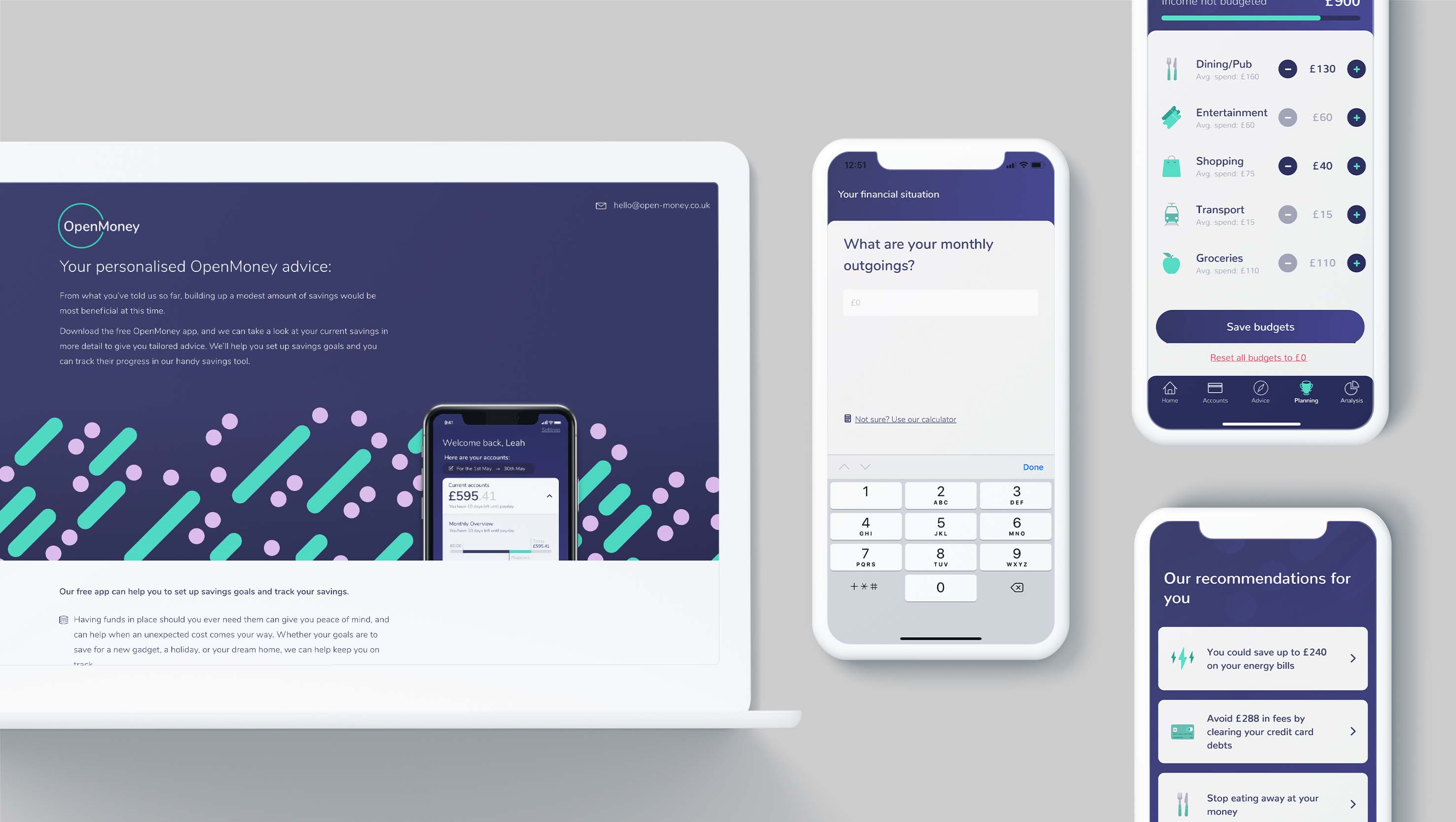

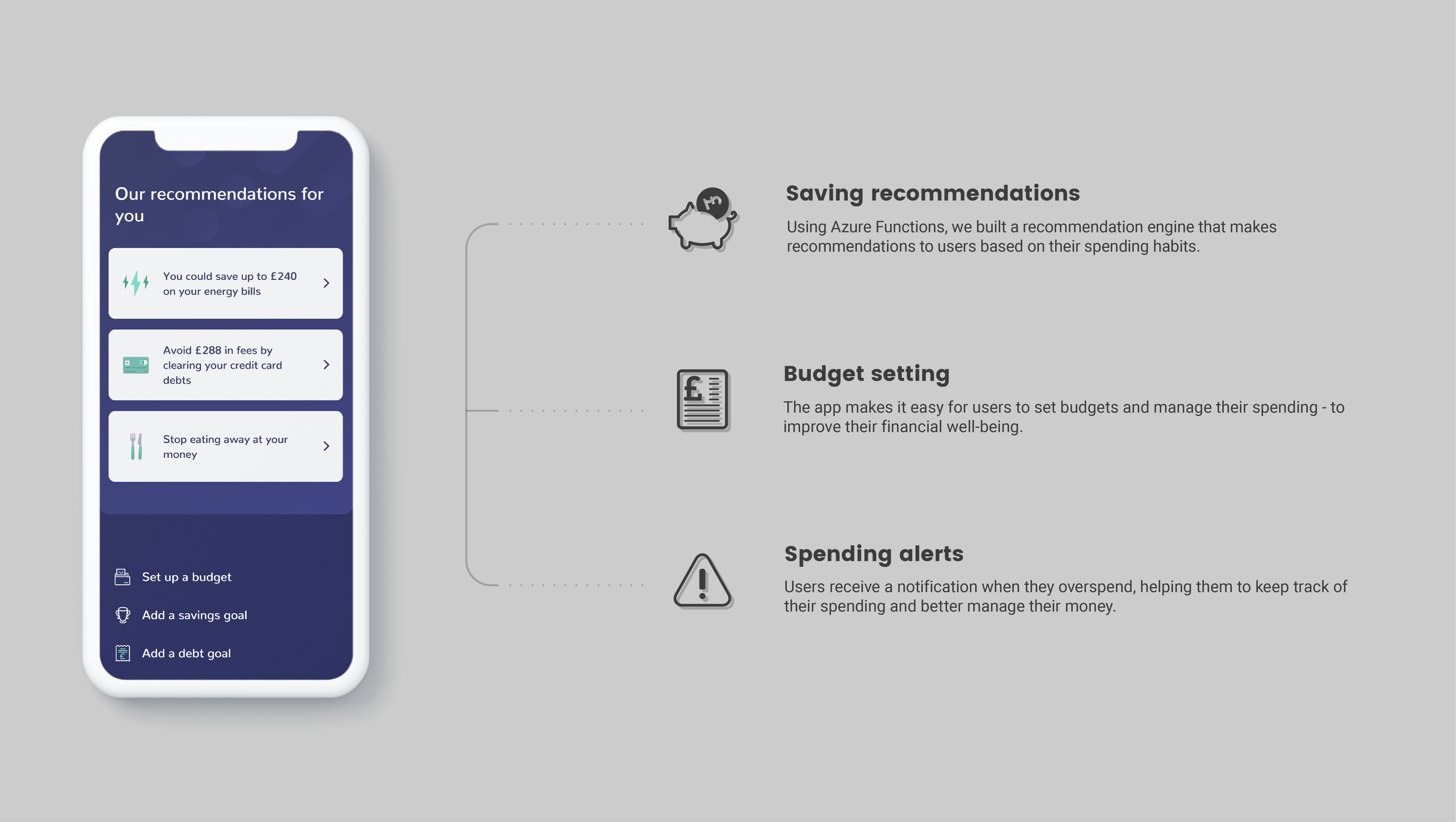

About OpenMoney

OpenMoney is on a mission to help millions across the UK build a brighter financial future.

With an impressive background in the financial sector, OpenMoney’s founders understood that a growing number of British people need financial advice but struggle to either access information or cannot afford financial advice.

OpenMoney exists to address this problem by making personal financial advice available to everyone.

.jpg)

.jpg?width=717&height=862&name=Open-money-case-study%20(3).jpg)

%20(2).jpg?width=717&height=862&name=open-money-finance%20(1)%20(2).jpg)

.jpg)