About Upside

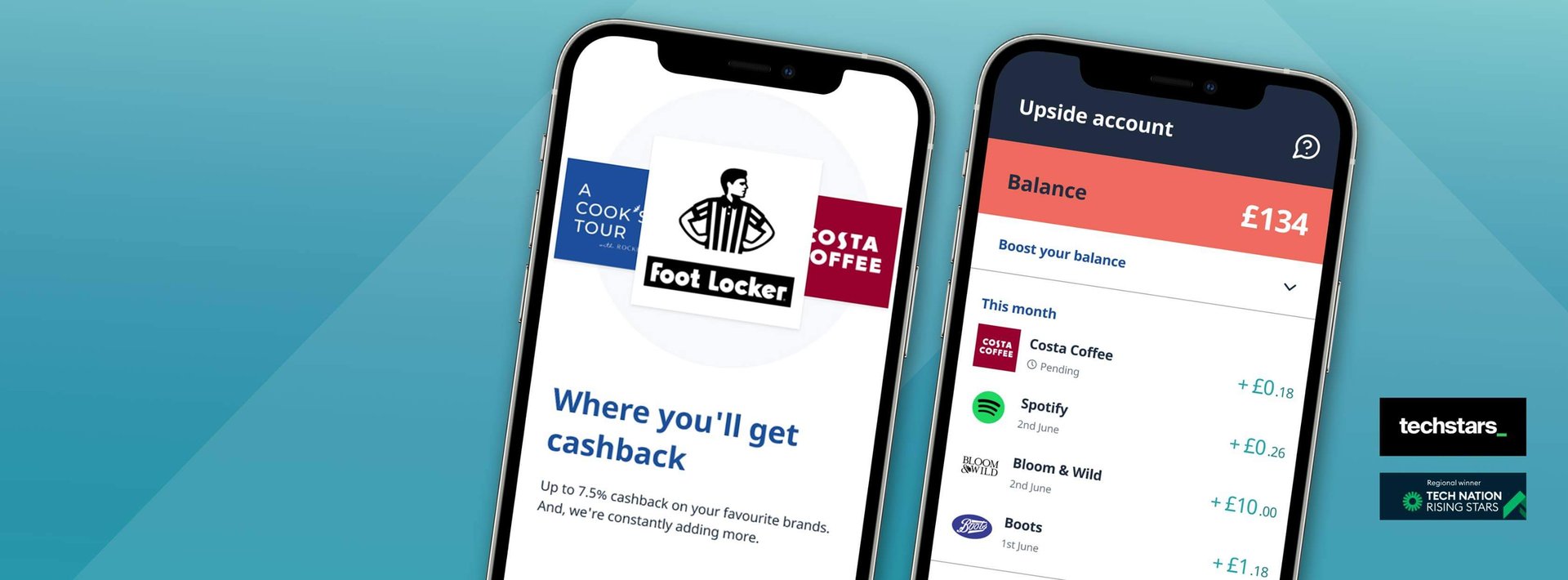

Did you know that more than 11.5m people in the UK have less than £100 in savings? Current savings solutions, such as round-up and habit changing apps, require sacrifice and effort from the customer.

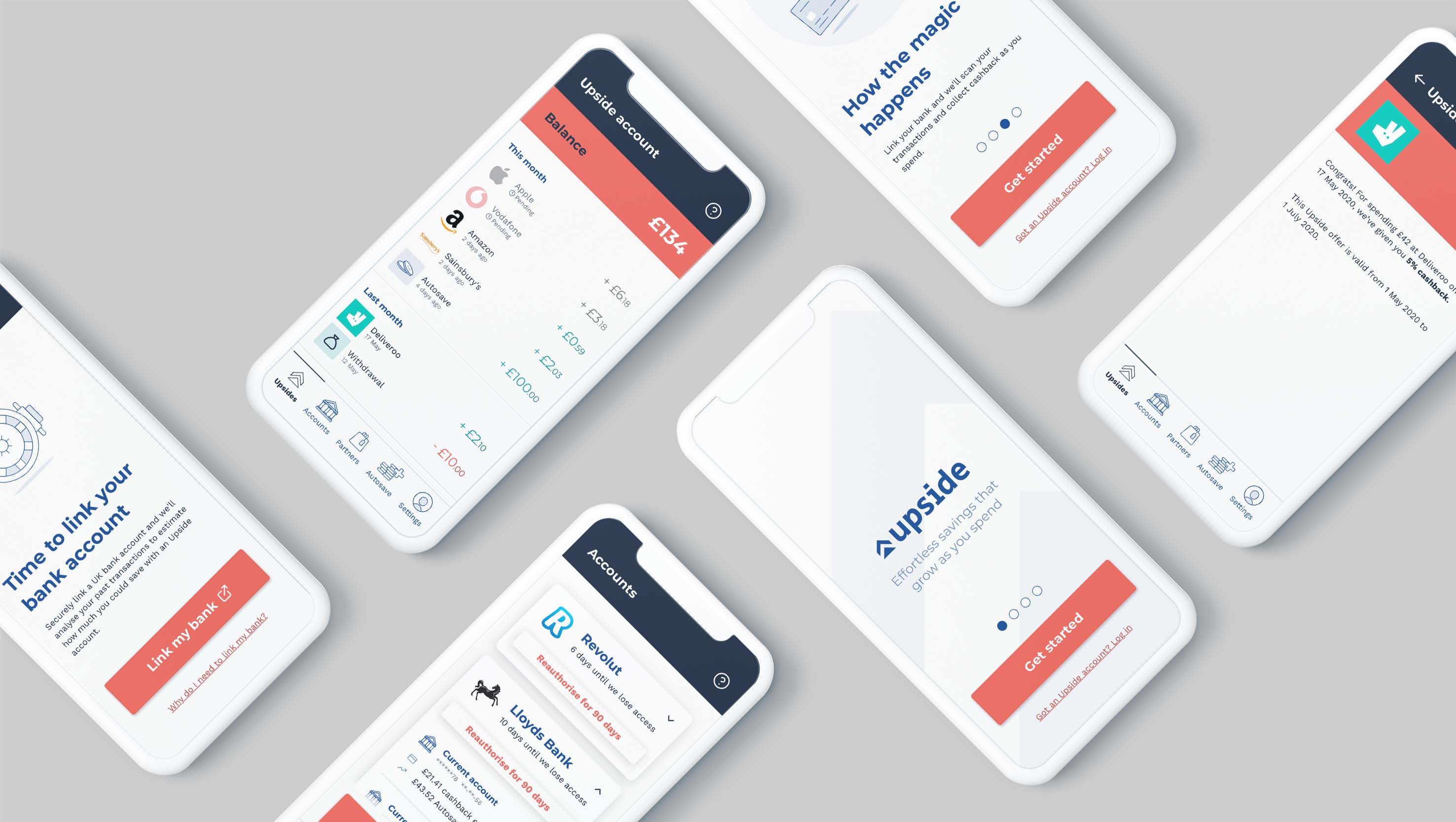

The founders of Upside wanted to make saving truly effortless with no effort or sacrifice. They believed they could find up to £1,250 savings for consumers - just by giving them cashback on their spending.

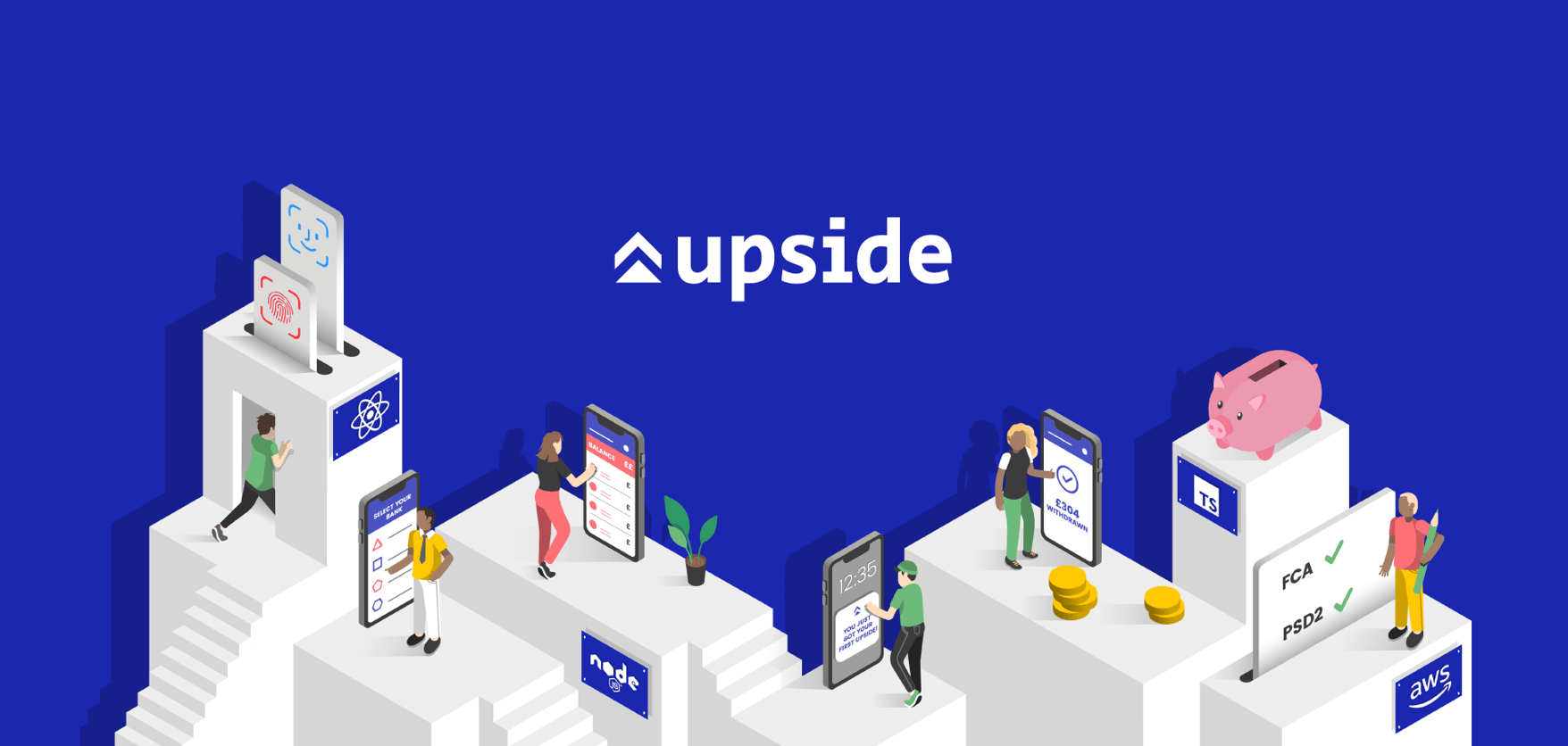

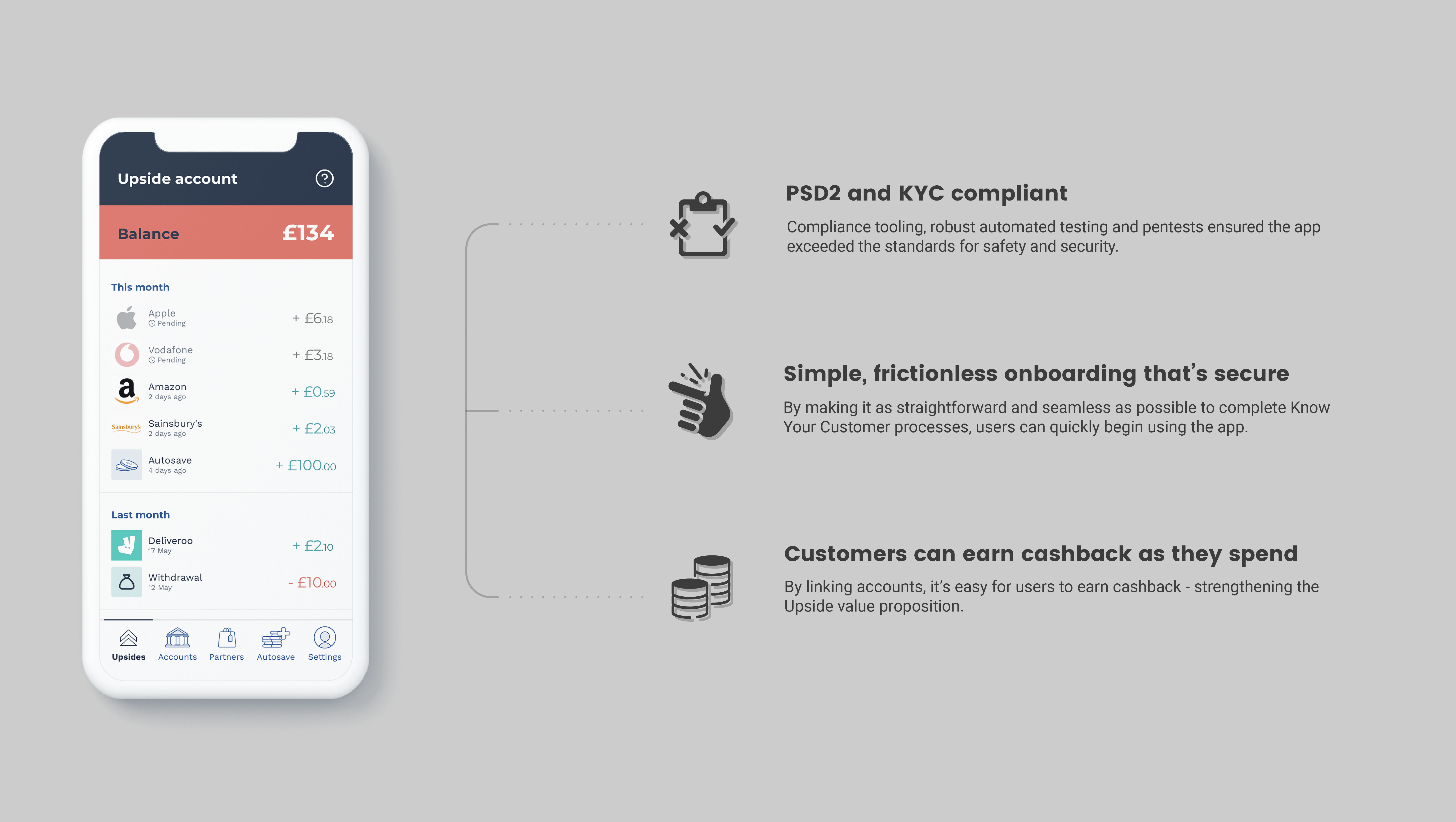

With a great idea, and a solid foundation to support it, Upside now needed to develop an MVP to prove its hypothesis that they could make saving effortless for people. To do this, they brought in AND’s technical expertise to bring the product to life.