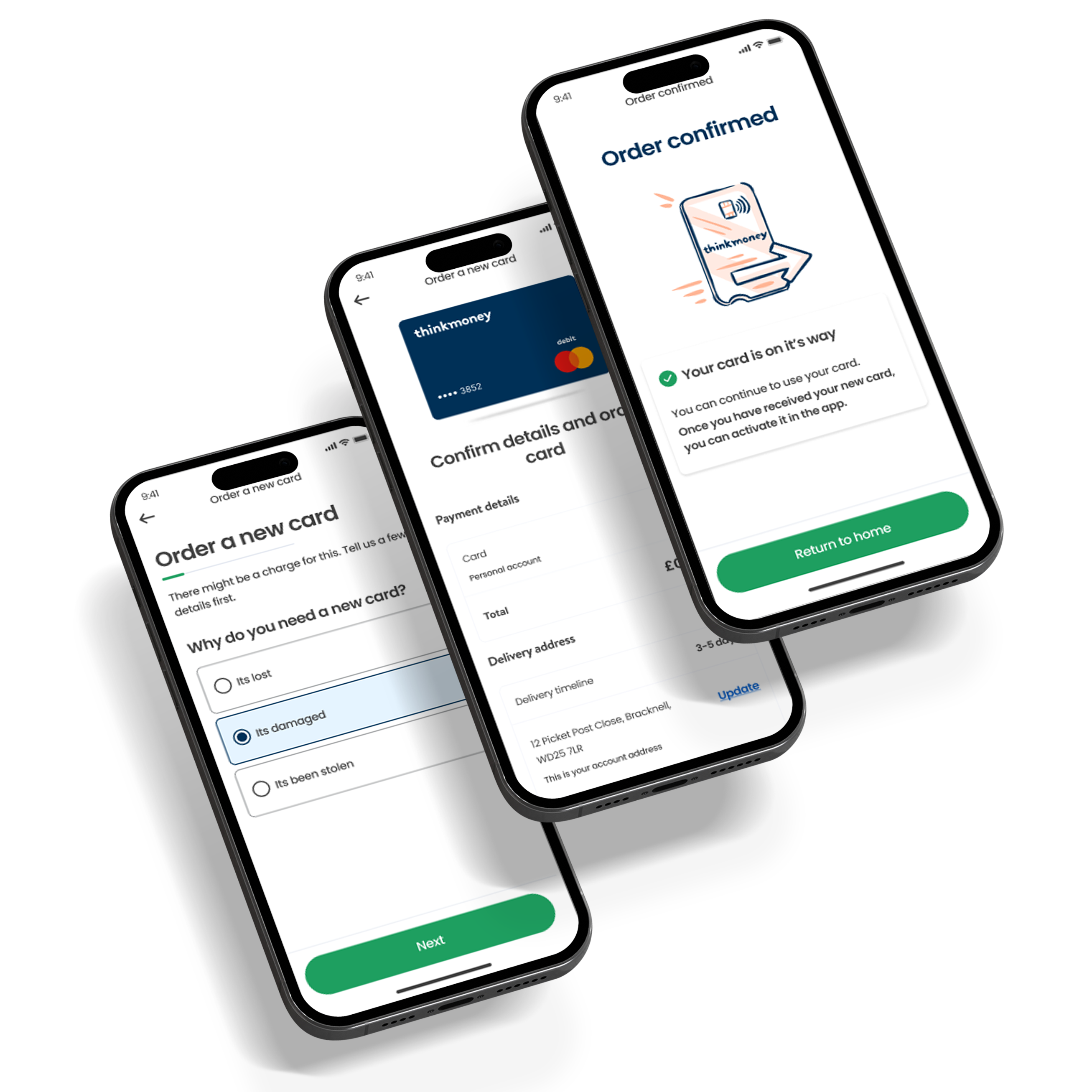

Over the course of 8 months, our partnership transformed thinkmoney's digital experience.

We successfully migrated 105,000 customers - including 68,000 app users - to their new platform and mobile apps, and we increased their app user base in the process.

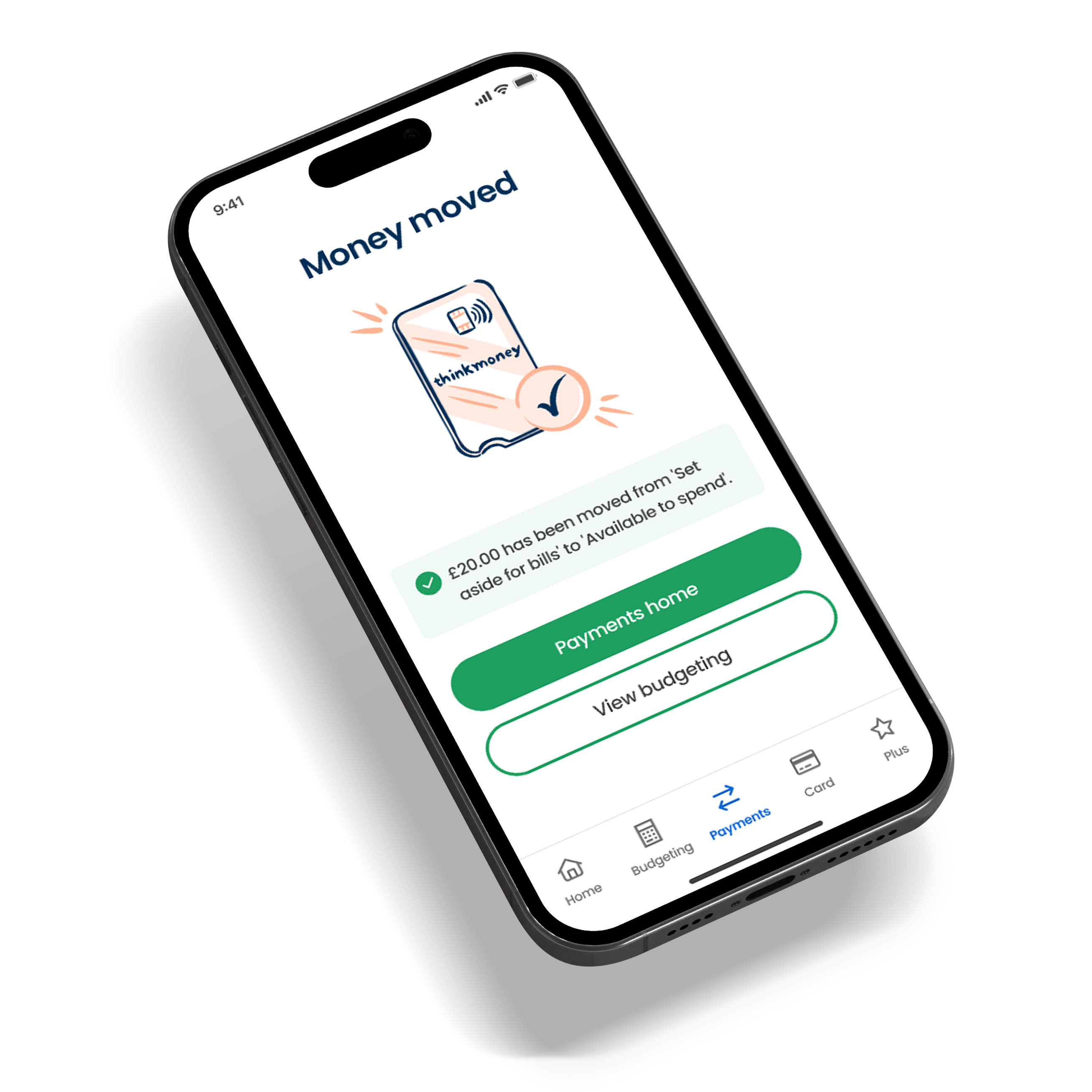

But the impact goes far beyond the numbers. thinkmoney now owns their entire digital experience, from the user-friendly app to the behind-the-scenes tech stack. They can rapidly launch new customer propositions like Apple Pay, Google Pay, Saving Pots and fresh account types, without being boxed in by their old platform's restrictions.

thinkmoney’s brand new back-office tools empower teams to provide seamless customer service, while intelligent features like Confirmation of Payee help keep customers' money safe from scams and errors.

Operationally, thinkmoney is seeing significant efficiency gains too. Calls to their contact centre have dropped by 50%, resulting in major cost savings. And their continuous delivery pipeline, coupled with a comprehensive design system, allows them to develop and release new app updates at pace.

Perhaps most importantly, thinkmoney's future is no longer constrained by technical debt or a third-party platform roadmap. With a modern, flexible AWS infrastructure and in-house expertise, they can drive their own innovation and growth for years to come.

.png)

.png)